The iPhone Trap: Why Indians Pay the Heaviest Price for Apple’s Brand Obsession

Apple has just unveiled its latest flagship, the iPhone 17 series, and global tech enthusiasts are lining up to grab the device. But in India, owning the new iPhone is less of a tech upgrade and more of a financial trap — and the numbers prove it.

Contents

The Price Disparity

The iPhone 17 Pro (256GB) highlights the stark pricing gap across countries:

- 🇺🇸 United States: ₹96,900

- 🇭🇰 Hong Kong: ₹106,400

- 🇯🇵 Japan: ₹107,600

- 🇦🇪 UAE: ₹112,800

- 🇻🇳 Vietnam: ₹117,000

- 🇸🇬 Singapore: ₹120,200

- 🇮🇳 India: ₹134,900

In simple terms, the same iPhone costs ₹38,000 more in India than in the US — a 40% markup. Add to that the harsh reality that the average Indian earns one-tenth of what an American does, and the burden becomes glaring.

Why Are iPhones So Expensive in India?

There are a few reasons behind this pricing torture:

- High import duties and taxes: India imposes steep customs duty and GST on imported products.

- Lack of large-scale local manufacturing: Unlike China or Vietnam, India is still ramping up iPhone assembly units, so dependence on imports remains high.

- Premium brand positioning: Apple doesn’t compete on affordability; it thrives by being aspirational.

The Indian Obsession with iPhones

Despite sky-high prices, India remains Apple’s fastest-growing market, with 12 million iPhones sold in 2024 alone. What’s more startling is how Indians are financing these phones:

- 7 out of 10 iPhones are bought on EMI

- Biggest buyers are 25-34 age group — young professionals chasing premium status symbols

- Most users upgrade every 2-3 years, even when their previous phone works fine

Essentially, Indians are stretching their finances — not out of necessity, but for the perception of status.

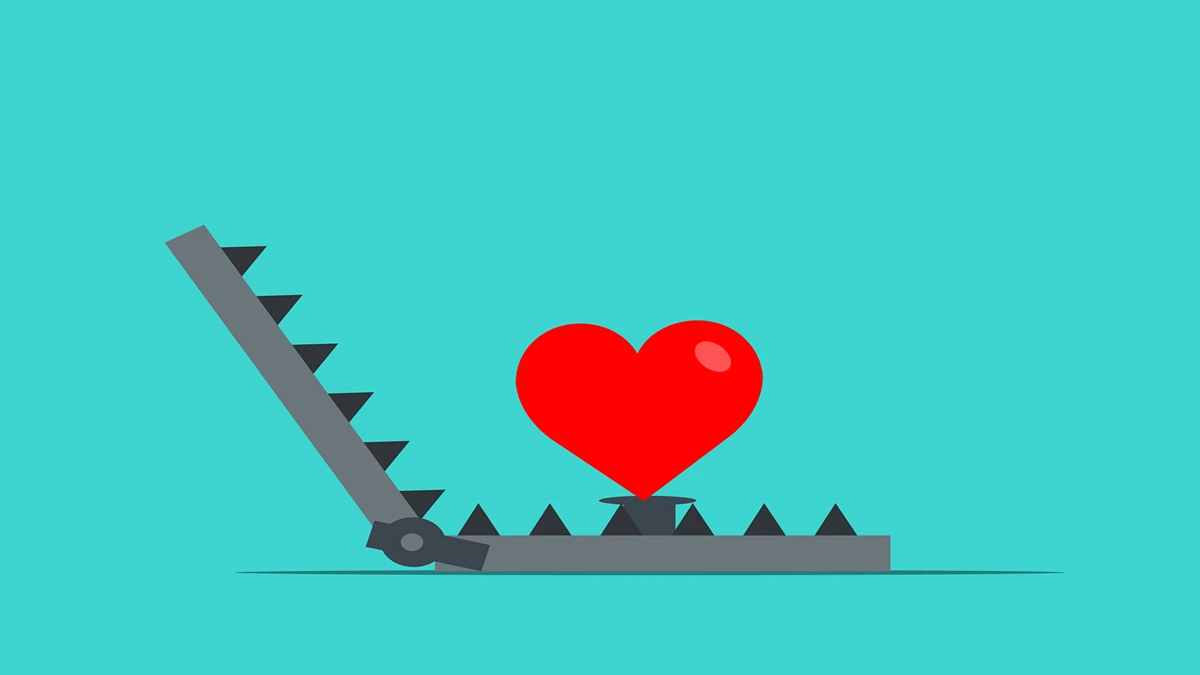

More Than a Phone: Buying an Identity

For many, the iPhone is not just a device but an identity. Owning the latest model is seen as a marker of success, sophistication, and upward mobility. But this social validation comes at a steep cost.

Financial experts warn that excessive EMIs are eroding savings, pushing even well-paid professionals into a lifestyle of “pay cheque to pay cheque” living. An iPhone may boost self-esteem temporarily, but it risks long-term financial stability.

The Bigger Picture

At its core, this is not just about Apple. It’s about consumer psychology, peer pressure, and misplaced priorities. As society glorifies luxury gadgets, young Indians increasingly sacrifice their financial freedom for momentary validation.

That shiny iPhone won’t pay your rent, fund your retirement, or secure your future. But its EMIs will quietly lock you into a financial cage.